Many global markets had a rather bumpy start to the year but managed to recover and trade near all-time highs. In January, among other things, Chinese equities made new multi-year lows, while Uranium hit its highest price since November 2007. Money market funds have seen inflows of $163 billion over the first 2 weeks of 2024, the highest amount ever. Tensions in the Red Sea have pushed international shipping prices up by nearly 50% year-on-year (but they are still nearly 70% below the levels we have seen in 2021). The U.S. economy grew by 3.3% in Q4 2023, well above expectations.

Overall inflation in the United States of America has seen mixed newsflow in January: While the headline Consumer Price Index in December was above estimates, the Producer Price Index and the Core Personal Consumption Expenditure showed a further decline. In Germany, inflation has accelerated again as the Consumer Price Index rose to 3.7% in December, although the Core CPI has fallen further to 3.5%. Due to the high expectations of interest rate cuts, especially in the US, it is worth keeping a close eye on inflation. In my humble opinion, with the benefit of hindsight,

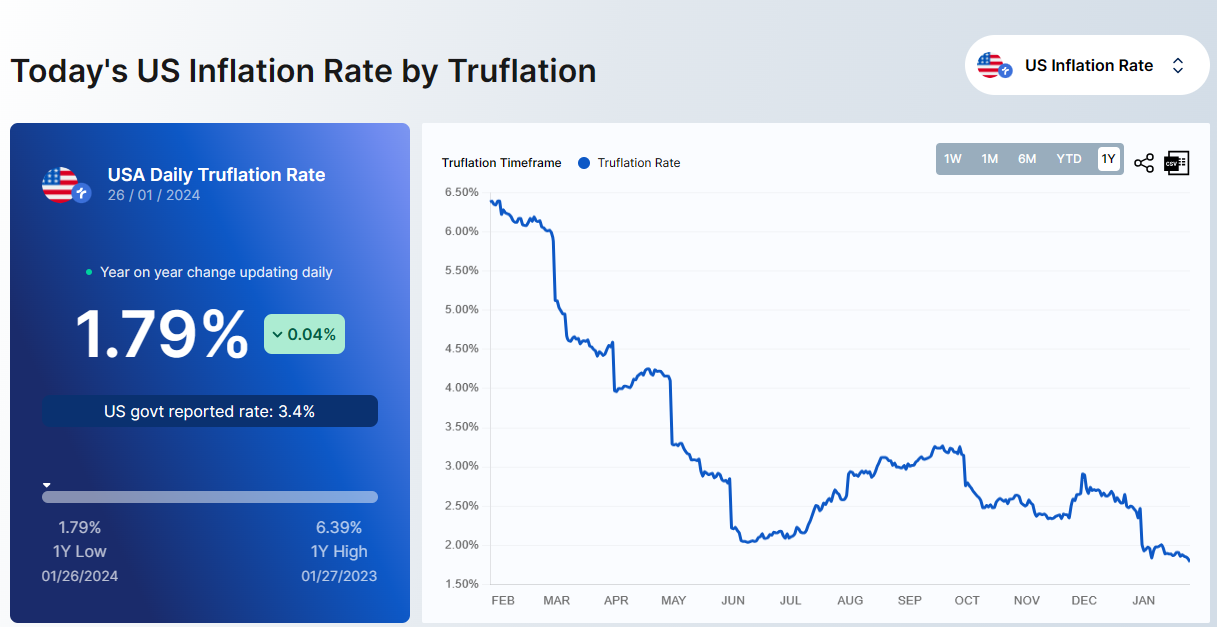

Truflation has provided one of the best indicators to show the direction of inflation recently. Truflation is an independent inflation index created to provide the most objective, decentralized and frequent inflation updates possible, according to their homepage. Therefore it is quite interesting to see that they calculate the Truflation at 1.79% (on 28 January 2024), well below the rates reported by the U.S. Government.

Source: Truflation

But as I can’t stress enough, we are not experts in predicting the future global economic development, but attempt to buy, and hold, the best companies we can find.

As earnings season for Q4 and the full year of 2023 is kicking off again, we want to stress again how important it is for our strategy to regularly be in contact with the companies we own (and those we have on our watchlist, of course). We aim to hear from our holdings at least once a quarter, and as most companies host a quarterly call or webcast to explain their results in great detail, we regard this as a valuable source of information. On top of that, we try and meet the management of our holdings on roadshows, conferences, investor days, or any other opportunities. Every call and every meeting helps us to deepen our understanding of the various business models (although as long-term investors the short-term share price volatility around results can be quite irritating and unexpected).

ASML was one of the first companies in Europe to report results. The company designs and manufactures photolithography machines which are essential to produce computer chips, and managed to more than double its sales since 2020. Every new semiconductor factory will have a machine from ASML at its core. It spends more than 4 billion Euros every year on Research & Development. Together with all the suppliers in the ecosystem, the total contribution to the Dutch economy, per annum, is around 20 billion Euros.

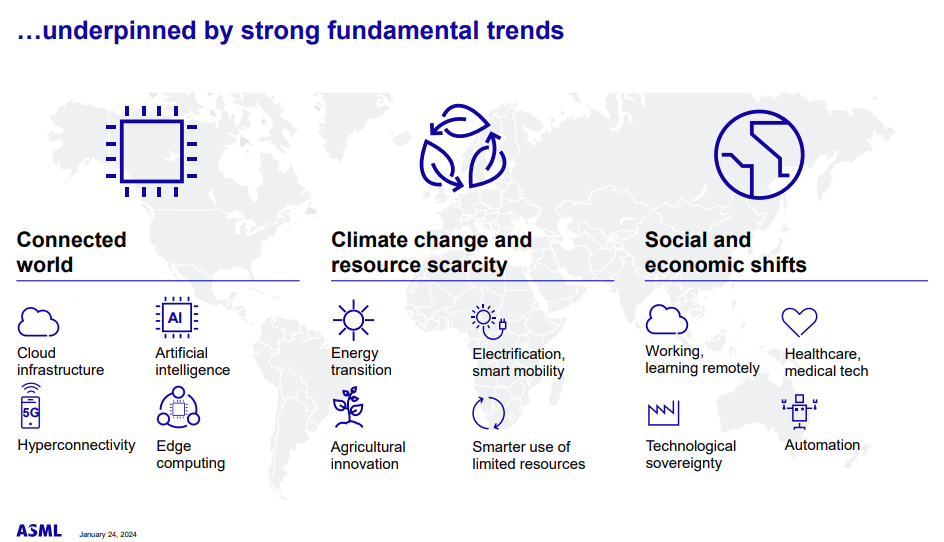

Semiconductors are at the core of many megatrends like Artificial Intelligence, cloud, energy transition, electrification, agricultural innovation, healthcare or factory automation. Semiconductors need to get smaller, more powerful, and more energy efficient.

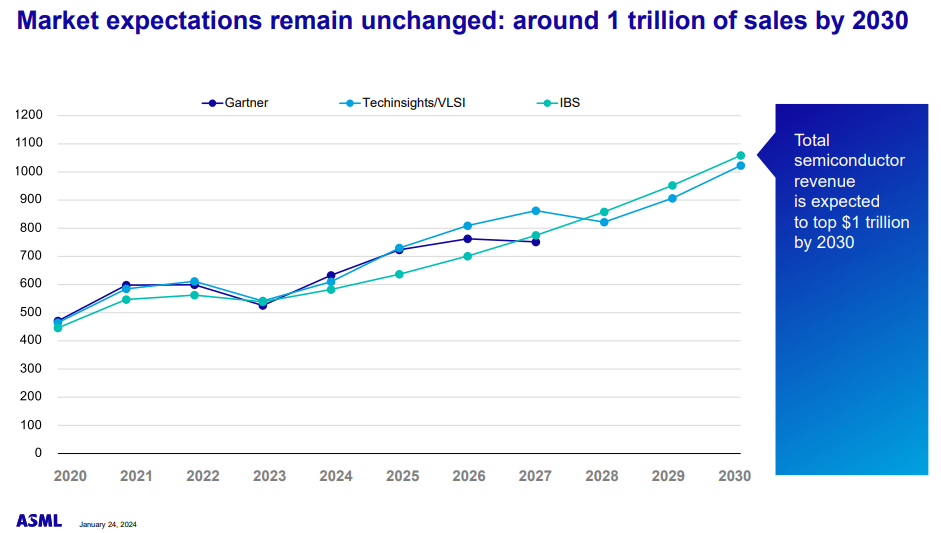

The total semiconductor revenue is expected to top $1 trillion by 2030, and after the boom thanks to Covid in 2021, and the following digestion phase in 2023, significant growth is expected in coming years

ASML’s order intake had been rather sluggish in 2023, as many projects for new factories had been delayed due to weakness in demand and/or delays in the construction of new factories, therefore all eyes were on order intake in Q4. The company truly delivered and announced the highest order intake in the company’s history of more than 9 billion Euros. While sales for 2024 are expected to only be flat versus 2023 (and are pretty much already secured), very strong growth is expected for 2025. Demand for semiconductors is picking up, and many countries have incentive programs for new factories in their territories. Examples are the U.S. CHIPS Act, which directs nearly $53 billion to “American semiconductor research, development, manufacturing, and workforce development”, or the European Chips Act, which earmarks 43 billion euros to build the semiconductor industry in the 27 member states, with the express aim of doubling their global market share from 10% to 20% by 2030.

LVMH reported results as well, and expectations were quite cautious.

Many analysts predict a sharp slowdown for the overall luxury sector after the extraordinary growth we saw when the world started to recover from the lockdowns. The company’s organic growth in constant currencies in 2023 was 13%, and growth in the second half of the year was around 10%. Quite importantly, the company managed its costs very well, so the margin surprised positively. Bernard Arnault's presentation was fascinating as usual. For example, when asked what he wants to do so that LVMH can grow faster, he said that he does not want the company to grow 20%. His aim is for the company to grow by 8%-10% every year, mainly driven by mix, and not volumes, as brand desirability is key. Quite interestingly, Mr. Arnaud said in his speech that he expects a good year for LVMH in the United States, as presidential election years are usually very dynamic (and as I pointed out in previous comments, had historically been very good years for the U.S. stock market as well).

Novo Nordisk reported strong results :It was not a big surprise !

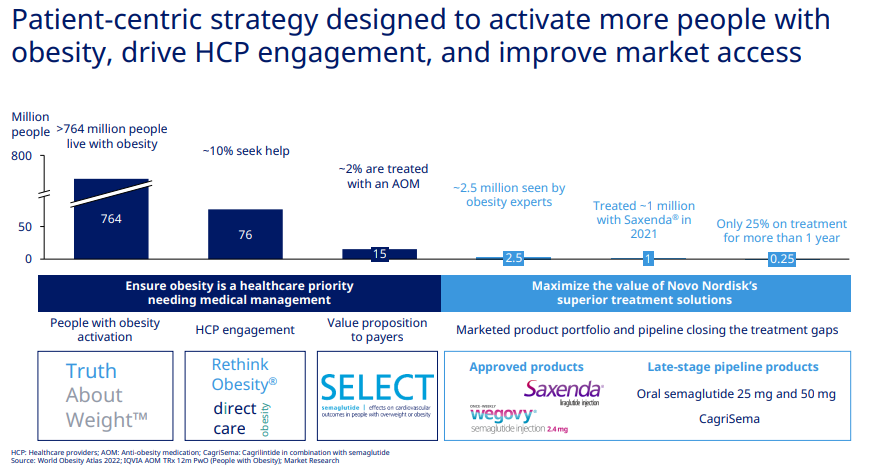

It is still worth highlighting that its diabetes business grew by 48% and its obesity business even by nearly 150% in 2023 compared to 2022. The popular obesity drug Wegovy reached sales of DKK 31bn, and this is expected to more than double this year. And nearly double the year thereafter. Obesity is a global epidemic, affecting more than 764m people. As can be seen in the chart below, only 2.5m people are seen by obesity experts, and just 1m were treated with Novo Nordisk’s drug Saxenda back in 2021 (the most up-to-date data point Novo Nordisk provides).

Source: Novo Nordisk

The MW Actions Europe fund is a compartment of the Luxembourg SICAV MW ASSET MANAGEMENT. You should contact the fund management company MW GESTION or your financial advisor for more information.

No information provided should be considered as a recommendation or an incitement to buy or sell and in no case management advice.

On the day of writing this article, MW GESTION ACTIONS EUROPE holds the following quoted securities:

- ASML for 6.6% of its outstandings

- LVMH for 4.5% of its outstandings

- Novo Nordisk for 5.5% of its outstandings