What happened in the markets last month

In contrast to normal seasonal patterns in election years, US markets hit new record highs in October, but then gave back some of these gains in the last days of the month. Both economic data and inflation data continue to surprise to the upside, raising questions about the FED's recent 50 basis point rate cut. This, together with firming odds of a Donald Trump election victory and cautious comments from FED officials on the pace of monetary easing led to a global debt sell-off, when for example the US 10-year yield rose from 3.62% in September to 4.28% at the end of October. The IMF lowered its global growth forecast for next year and warned of accelerating risks from wars to trade protectionism.

In the Eurozone, stronger-than-expected GDP growth was coupled with mixed inflation data. Growth in the 20-nation currency bloc quickened to 0.4%, while economists had predicted it would hold steady at 0.2%, as momentum in France accelerated and stayed strong in Spain. Germany’s surprise 0.2% increase in gross domestic product caught analysts off guard, though the reading for the previous three months was revised down sharply. The weak point was Italy, where output was unexpectedly flat, driven by a negative contribution from net trade. Both the European Central Bank and the Bank of England cut rates, as expected, and it is worth noting that 71% of major central banks are now easing their monetary policy. France delayed its 3% deficit target and was subsequently downgraded by rating agencies.

China expressed confidence in reaching its economic targets this year and promised to further support growth. After the return from the Golden Week holiday, Chinese markets skyrocketed over 10% at the open, but paired gains to a 5% rise later in the session as authorities disappointed markets by not providing more detail on the stimulus measures. Gold marked new record highs and silver rallied strongly, while oil was very volatile and ended the month slightly positive.

What happened in the fund in the last quarter

Quarterly earnings led to increased volatility, especially in the semiconductor sector. ASML’s share price fell sharply after the company issued a surprising profit warning for next year. Sales are seen below previous expectations as some key customers, among them Intel and Samsung, pushed out some of their orders. And while business at TSMC, another key customer, is booming, it could not offset these effects. Artificial Intelligence is growing rapidly, but is only a small part of the global semiconductor market currently, and cannot compensate the weakness in other, far bigger, areas like automotive, industrial, PC and smartphones.

The company will present its new long-term targets in November, and was very clear in its comments that the long-term outlook for the sector is intact, and that orders from clients were delayed, but not cancelled. This negative surprise led to a sharp underperformance for many stocks in the sector globally. And even positive surprises, like a better-than-expected order intake at ASM International, failed to improve the sentiment. Its share price saw a relief rally after the results release, but gave back most of these gains thereafter.

Trends in the luxury sector were mixed. While (less wealthy) ‘aspirational’ clients, especially in China, are struggling due to the uncertain economic environment and hefty price increases in recent years, the wealthiest consumers are in good shape. This was evident in the results of LVMH on the one hand, which reported a sales decline of more than 4% in the last quarter, while Hermes on the other hand reported strong demand and saw its sales increase by more than 10%.

SAP reported solid results, driven by its cloud business, which rose by nearly 30% compared to the same quarter last year. Globally, the economic uncertainty is high and growth is weak in many countries, which leads many companies to reduce their costs, for example by postponing purchases of new IT equipment like laptops or PCs. SAP nevertheless has one of the best growth profiles in the sector, as its products are in most cases absolutely crucial for the operations of its clients. The biggest part of its growth comes from its existing clients, who strategically see the need to upgrade their products and/or move applications into the cloud. Quite interestingly, nearly one third of the products now come with applications using Artificial Intelligence, and the company is confident that this can be monetized.

Looking ahead

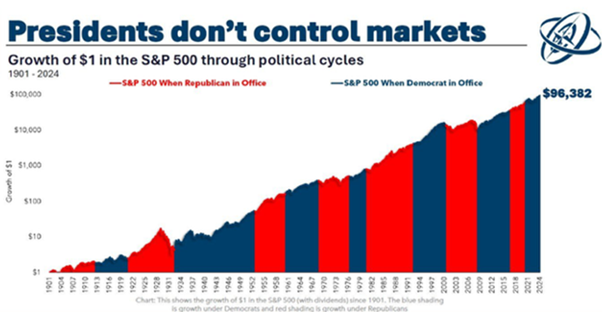

At the time of writing, Donald Trump has been declared as the new President of the United States of America. This has been one of the key topics for markets in recent months, when people tried to predict winners and losers for any possible political scenario. If we look back in history, though, the most important drivers for stock markets have been earnings. Hence, it is no surprise that in the past, it did not really matter which party was in power, and of the two candidates, many regarded Trump as more business-friendly. Short-term trading on (political) events is not part of our investment strategy, though, and we keep focussing on companies with strong market positions, low debt levels, and good prospects for solid growth of sales and earnings.

Source: Ritzholz

Written on 14 November 2024

On the day of writing this article, MW GESTION ACTIONS EUROPE holds the following quoted securities:

- ASM International for 5,3% of its outstandings

- ASML for 5,7% of its outstandings

- Hermes for 2,8% of its outstandings

- LVMH for 3,3% of its outstandings

- SAP for 4.1% of its outstandings

Communication-Marketing

The MW Actions Europe fund is a compartment of the Luxembourg SICAV MW ASSET MANAGEMENT. You should contact the fund management company MW GESTION or your financial advisor for more information.

Past performance is not a reliable indication of future performance. Past performance is no guarantee of future performance.

The content does not constitute a recommendation, an offer to buy, a proposal to sell or an invitation to invest.

Further information is available on the company's website: www.mwgestion.com, in French, English and Italian.