What happened in the markets

Over the past month, U.S. markets and politics were shaped by intensifying trade tensions and renewed pressure on the Federal Reserve. President Donald Trump escalated his public conflict with Fed Chair Jerome Powell, calling for aggressive rate cuts and even suggesting Powell should resign if inflation figures were being misinterpreted. Despite this pressure, the Fed left interest rates unchanged. Trump also expanded his trade offensive, and the average US tariff rate will rise to more than 15% if rates are implemented as announced. At the same time, he introduced a major fiscal package featuring tax cuts and reduced social spending, which successfully passed both the Senate and the House.

Despite heightened geopolitical risks, markets proved resilient. The S&P 500 and Nasdaq reached new all-time highs, supported by strong labour market data and robust consumer demand. Inflation pressures remained contained, even as tariff threats mounted. A trade agreement with Japan helped lift sentiment, though uncertainty persisted around U.S. monetary policy, trade relations, and Trump’s political standing, which fell to its lowest second-term approval rating at 37%.

In Europe, trade pressure from the U.S. also intensified. The European Union ultimately accepted a 15% tariff on most exports in exchange for large-scale purchases of American energy and commitments to invest in the U.S. Euro area inflation reached the ECB’s 2% target in June, prompting the central bank to keep interest rates unchanged amid signs of economic resilience, including a slight uptick in the composite PMI. In France, the government unveiled major fiscal reforms aimed at narrowing the deficit, including tax hikes, benefit freezes, and the elimination of national holidays. Germany's economic picture was mixed: May factory orders and trade data disappointed, but economic sentiment improved, and real 10-year bond yields climbed to their highest point since 2011.

Meanwhile, global commodities and financial markets saw some big moves. OPEC+ surprised markets by raising oil production, sending crude prices lower. Copper surged to record highs following Trump’s announcement of a 50% tariff on imports, while silver and platinum also reached multi-year peaks. Bitcoin hit new all-time highs, and retail investors poured a record amount into U.S. equities and ETFs in the first half of the year. Volatility fell sharply, with the VIX hitting its lowest level since early 2020, as broader uncertainty around trade and geopolitics eased.

What happened in the fund

The quarterly earnings season kicked off again, and began with a big disappointment from ASML Holding, as shares fell more than 10% after results. Q2 results and the Q3 outlook were solid, with bookings coming in 16% above estimates. But surprisingly the company said that it cannot guarantee that 2026 will be a growth year, which was a significant change from its previous wording. As a reason for this, the company cited higher customer uncertainty around tariffs and geopolitical risks.

Another semiconductor company, ASM International fell more than 10% due to disappointing order intake numbers. While the company also mentioned increased uncertainties regarding tariffs, orders are expected to pick up in coming quarters as underlying demand drivers are intact. In this context, it is important to look at the big picture, which shows an ongoing healthy demand for Artificial Intelligence. Alphabet, for example, announced a significant increase of its investments. This means that more chips need to be produced, and with that, more new fabs with new machines will be needed, which will benefit companies with a technological edge and a high market share, like ASM International and ASML. Orders could be pushed back by one or two quarters due to geopolitical uncertainties, but if underlying demand goes up, orders will have to be placed with ASML and ASMI.

LVMH reported underwhelming results as well as organic sales in the second quarter fell by 4% overall, and by nearly 10% in its most important division, Fashion & Leather Goods. Just like in the first quarter of the year, the company pointed out that in the first half of last year, Chinese tourists took advantage of the weak Japanese Yen, which led to sharp growth in its Japanese business, which is normalizing this year. Growth was more or less flat in both Europe and the United States. The stock reacted rather positively, as these issues had been well known, and going forward, the big question is if this quarter has marked the bottom.

Novo Nordisk has cut its outlook for the second time this year. This is a bit surprising, as most analysts were pointing out that most recent trends for its drugs in the important US market were improving, and new collaborations would increase sales further. The company promoted an internal candidate to become the new CEO, hence the profit warning could be regarded as kitchen sinking. As we were hoping for the above-mentioned improvement in the operating performance, we held a small holding, which we halved on the day of the profit warning, when the stock fell more than 20%.

Outlook

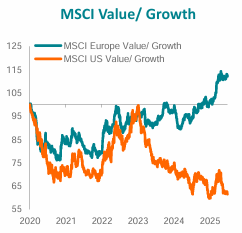

European growth stocks have significantly underperformed since 2022. The chart below shows that Value has substantially outperformed Growth in Europe (green line), while in the US the opposite is true (orange line). Such a divergence is unusual: both the spread between Growth and Value in Europe and the gap between European and US Growth performance are currently at extreme levels.

Source: BNP Exane Paribas

Looking at sector performance in Europe year-to-date at the time of writing, typical growth sectors such as Healthcare (–9%) and Technology (–1%) have underperformed the market, while value sectors such as Banks (+36%), Construction (+16%) and Utilities (+14%) have posted strong gains. Europe’s top performers have been defense stocks, driven by increased defense spending across the region.

The key question is whether the underlying drivers for sectors like Healthcare or Technology have fundamentally changed over the past three years. While tariffs and potentially lower prices in the US may be headwinds, the global population—especially in developed markets—is aging and facing rising healthcare needs. In addition, Artificial Intelligence shows no signs of slowing, as evidenced by recent quarterly results from Alphabet and Microsoft. The amount of data being collected and analyzed is growing at an accelerating pace.

Furthermore, although many luxury companies have struggled year-to-date, global wealth continues to rise, supported by the rally in asset prices. We believe these long-term structural trends remain intact, and with an expected average earnings growth of more than 15% across our holdings this year (based on analysts’ estimates compiled by Bloomberg), the short-term outlook is also encouraging.

Wrtitten on 7 August 2025

On the day of writing this article, MW GESTION ACTIONS EUROPE holds the following quoted securities:

- ASM International for 3.8% of its outstandings;

- ASML for 5.4% of its outstandings;

- LVMH for 1.7% of its outstandings;

- Microsoft for 3.3% of its outstandings;

- Novo Nordisk for 0.8% of its outstandings;

The MW Actions Europe fund is a compartment of the Luxembourg SICAV MW ASSET MANAGEMENT. You should contact the fund management company MW GESTION or your financial advisor for more information.

Communication-Marketing

The MW Actions Europe fund is a compartment of the Luxembourg SICAV MW ASSET MANAGEMENT. You should contact the fund management company MW GESTION or your financial advisor for more information.

Past performance is not a reliable indication of future performance. Past performance is no guarantee of future performance.

The content does not constitute a recommendation, an offer to buy, a proposal to sell or an invitation to invest.

Further information is available on the company's website: www.mwgestion.com, in French, English and Italian.