DISCOVER OUR OTHER FUNDS

Manager

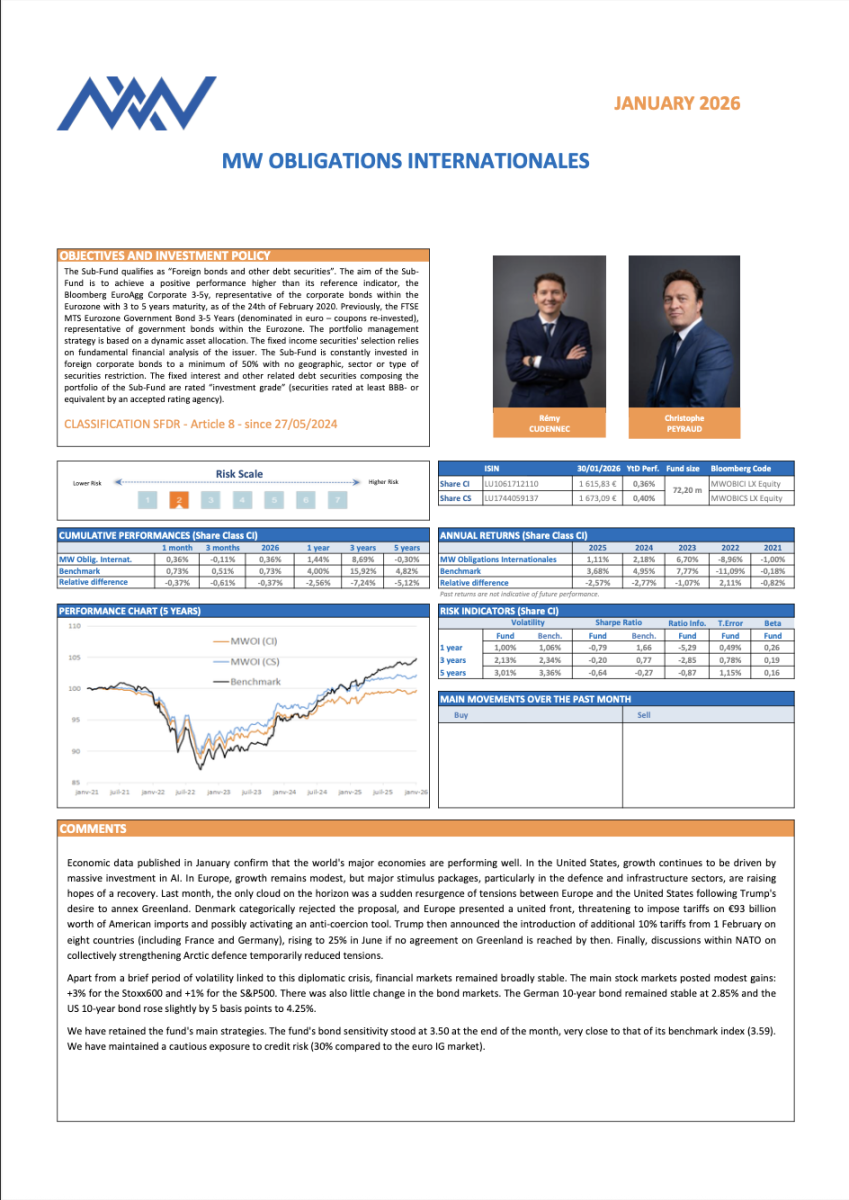

Christophe PEYRAUD

Rémy CUDENNEC

RECOMMENDED MINIMUM INVESTMENT DURATION

RECOMMENDED MINIMUM INVESTMENT DURATION

GLOBES

Article 8 SFDR classification

Le 31/07/2024

.png)

.png)

.png)

.png)

.png)

MORNINGSTAR

SHARE R

Le 31/08/2024

.png)

RISK SCALE

Lower Risk Higher Risk

Potentially

lower returnPotentially

higher return

Actif net : 63 331 935.66 €

The market is a device for transfering money from the impatient to the patient

Warren Buffet

+ About This fund

This fund is marketed in France, in Germany and Luxembourg. It can only be subscribed by foreign professional clients (institutional, sub-mandated clients) and residents of Luxembourg, France, and Germany.

The MW Obligations Internationals fund of the Luxembourg SICAV MW ASSET MANAGEMENT is invested in international bonds by private issuers, almost exclusively denominated in euros, to benefit from a higher yield than government bonds. The bond portfolio's average rating is in the grade “BBB” for the majority (around 70%) of the portfolio. The balance may be invested in more speculative bonds with a particular focus on credit quality (maximum 10%), convertible bonds (maximum 20%) and non-rated issuers by rating agencies (maximum 10%).

Evolution based on 100 over the selected period

Cumulative performances

The performance shown is not a reliable indication of future performance. Past performance is not a guarantee for future performance.

Specifications

| CARACTÉRISTIQUES | |

|---|---|

| Code ISIN | LU1061712110 |

| Code Bloomberg | MWOBICR LX Equity |

| Date de Création | 01/08/2014 |

| Indice de référence | Bloomberg – Barclays Euro Aggregate Corporate 3 – 5 ans |

| Classe d'actifs | Obligations Internationales Privées |

| Forme | Compartiment d’une SICAV Luxembourgeoise |

| Durée de placement | entre 3 et 5 ans |

| Valorisation | Quotidienne |

| Centralisation | Chaque jour à 15h00 |

| Devise | EUR |

| Gérant(s) | Christophe PEYRAUD - Rémy CUDENNEC |

| Dépositaire | CACEIS LUXEMBOURG BRANCH |

| Gestionnaire | MW Gestion |

| Commission de souscription | 1% max |

| Commission de rachat | 0.5% max |

| Frais de gestion | 1% TTC |

.png)

.png)