December was a very eventful month. Among other things, Chinese stocks have fallen to their lowest level in the last 5 years, the Bloomberg Commodity Index dropped to a 2-year low on demand fears, Uranium and Bitcoin prices were surging, and the average credit card interest rate in the US now has risen to 27.81%! Inflation in the US continued to moderate as the Consumer Price Index moved down from 9.1% in June 2022 to 3.1%, and the Core Producer Price Index fell back down towards 2%. China is the only big country experiencing deflation as the Consumer Price Index is down 4.7% since 2020.

The most important event, though, was the dovish turn of the US central bank FED, indicating no more hikes and 75 bps of cuts in 2024. This resulted in a new all-time high for the Dow Jones Index and has sent the volatility index VIX to the lowest levels since 2019. Longer-term inflation expectations have fallen dramatically over the past two months, close to the FED’s 2% target.

At the end of December, markets priced in a more than 80% chance that rate cuts in the US will begin in March 2024, and the base case showed 6-7 (!) interest rate cuts in 2024. Sentiment was extremely positive, the CNN Fear and Greed Index moved into ‘Extreme Greed’ territory, and the Bulls outnumbered Bears by 32% in the AAII Sentiment poll, showing the largest positive spread since April 2021.

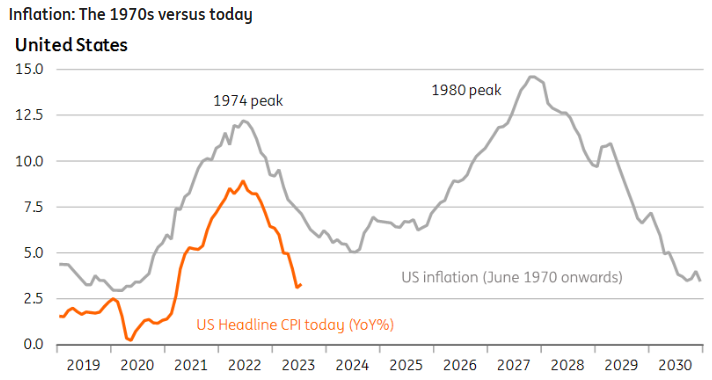

Together with the strong performance of many stock markets around the world in 2023, this creates very high expectations for the start of 2024. And while it is our belief that nobody can predict the future, one should be aware of consensus expectations, and potential risks to them. The below chart shows one of the biggest risks to these expectations: a rebound of inflation, as was the case in the 1970s.

US 10-year government bond yields have rallied from around 1% at the beginning of 2021 to a peak of 5% in October 2023, only to fall below 4% after the FED meeting in December. The German 10-year government bond yield rose from -0.5% at the beginning of 2021 to nearly 3% in October 2023, and fell back to below 2% at the end of December. This drop over the last 2-3 months of the year was accompanied by a sharp rally in global equity indices, and surely a rebound of inflation would be quite negative for stock markets around the world. Strategist forecasts in December for the Euro Stoxx 50 and the S&P 500 in 2024 showed little optimism with an average expected upside of 0.5% and 2.8% compared to the closing prices of 2023.

We are, though, not trying to predict the future, but buy companies which have proven that they can navigate choppy waters and difficult economic environments thanks to their superior market position and strong balance sheets.

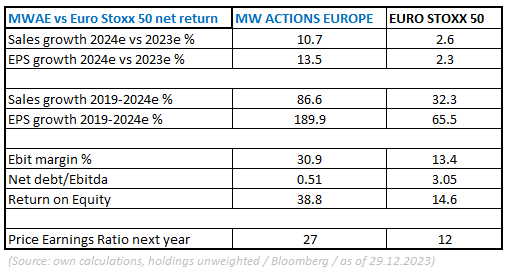

As a quick reminder, please see below the current characteristics of our fund.

The companies we own have superior sales and earnings growth, high margins, low debt, and high returns on equity. It is our ambition to buy such beautiful companies and hold them as long as possible to benefit from the compounding of their earnings.

One could see the fund’s returns over 5 years as proof of concept, as the investment style has been amended during the second half of 2018 in favour of quality and growth companies (and it is worth noting that we still own quite a few of the shares which had been bought back then). Since the end of 2018, the annual return of the fund (class CI) has been close to 12% (according to Bloomberg). As we aim for annual earnings growth of 10%+ for all our holdings, this shows how the underlying earnings growth of our portfolio companies is mirrored by the performance of the fund over longer periods of time. As can be seen in the table above, our holdings’ earnings should continue on this sustainable growth path and are expected to increase by circa 13% in 2024.

While we cannot, unfortunately, foresee the future, or guarantee a good performance, we can try our best to own the most beautiful companies which have the potential to sustainably grow their earnings over the short- and long-term!

Last but not least it is worth highlighting that the S&P500 has finished in the green in 13 of the last 15 US Presidential Election years with an average gain of 10%. The only two times it finished in the red were the Global Financial Crisis and the Dot Com Bubble. Excluding those events, the average yearly gain is 15%.

We wish you all the best for the new year.

Flash written on January 16, 2024

Past performance is no guarantee of future performance. The content does not constitute a recommendation or a sales proposal, nor does it encourage investment.