What happened in the markets last month

In May, the Dow Jones Industrial Average, S&P 500 Index and Nasdaq Composite climbed to record highs, and in Europe, among others, the German DAX and the French CAC 40 followed. This is despite the fact that economic data in the US was weakening. The US Macro Surprise Index, for example, hit its weakest since January 2023, and US job openings dropped in March to the lowest level in 3 years. In Europe, though, it looks as if the overall economic activity is picking up while disinflation continues. The US bond market has been in drawdown for 45 months, by far the longest bond bear market in history. Commodity prices have surged to their highest level in 13 months. Gold and Copper hit new record highs and Silver closed above $30 for the first time in over a decade while on the other hand Cocoa suffered its biggest loss in 65 years. All-time highs were reported in global debt levels, which rose to $315 trillion in Q1, and in US consumer credit card debt (at a time when personal savings are at a record low). Bitcoin fell more than 20% from its peak and entered bear market territory early in the month, but rebounded rather quickly. The volatility index VIX closed below 12 for the first time since November 2019, and CNN’s Fear and Greed Index returned to ‘neutral’.

What happened in the fund last month

Apple : Since the beginning of the year, there were plenty of reports about Apple’s difficulties in China. And during the company’s second quarter, iPhone revenues indeed fell by 10%. The shares rose nevertheless as the Service business increased sales by 14% to a new record level, and overall earnings per share set a new record for a second quarter. Services include for example AppleCare, Apple Pay, iCloud storage services, and subscriptions to Apple Music, Apple Arcade or Apple TV+. Apple’s installed base has surpassed 2.2 billion active devices worldwide, and it is quite impressive that customer satisfaction for iPhones is at 99% (in the US, but probably on similar levels in other regions as well). Very recently an American broker published a very optimistic report about the company, claiming that AI (Artificial Intelligence) technology being introduced into the ecosystem would bring ample monetization opportunities on both the services as well as iPhone front. And last but not least, Apple announced a $110 billion share buyback plan, the largest buyback ever in the US. Apple has bought back $625 billion in stock over the past 10 years, which is greater than the market cap of 492 companies in the S&P 500!

In this context it is worth noting that US stock buybacks are projected to reach a record high $1.1 trillion next year. Why this matters can be seen in the table below. From 1963 – 2023, companies which repurchased shares (on the left) have regularly outperformed those companies which issue shares. On the very right side of the table are the companies with the highest share issuance, and they underperformed both the stock repurchasers and the companies which neither issued nor bought back shares in nearly every decade!

Both Ferrari and Novo Nordisk published results in the last month as well, and despite good results, the share price reactions were rather muted. In the first quarter of the year, Ferrari shipped 7 cars less than in the year before. But thanks to a stronger product and country mix as well as a greater contribution from personalizations (e.g. special colours of the car or the leather), revenues increased by 11% and net profit by 19%. Some market participants apparently were disappointed by comments on the order book, which according to Ferrari continues to be ‘very strong’, while in previous quarters the company talked about a ‘record order book’. Nevertheless, most models are sold out, and visibility goes well into 2026. It was quite interesting to hear as well that in 2023, 74% of cars were sold to existing customers.

Novo Nordisk reported for its first quarter a sales increase of 24% while earnings per share increased by 29%. The company slightly increased its outlook, which led to some disappointment, as its competitor Eli Lilly a few days earlier had increased the outlook more significantly.

The fact that global markets came to a standstill in the days before Nvidia’s results is rather strange. Ahead of the results, options markets priced in a move of 9%, which is basically the market capitalization of Switzerland’s Roche (and as it turned out, that forecast was quite accurate). After the results, Nvidia’s market capitalization surpassed the entire German stock market. In the first quarter of the year, Nvidia was able to increase its revenues by 262% and its earnings per share by 462% year over year, and the gross margins reached an impressive level of 78.9%. The outlook for the second quarter was well above expectations as well, and the concern coming into results of an air-pocket in demand clearly did not materialize. To put things into perspective, according to Bloomberg estimates, the company is expected to increase 2025 revenues by more than 10x versus 2020 (and to then double them again by 2028), while earnings per share are set to increase to around $26 versus just above $1 in 2020 (and to increase to nearly $40 in 2028).

Nvidia’s biggest customers are Alphabet, Amazon, Meta Platforms and Microsoft, so as long as they keep on investing in Artificial Intelligence, they will need Nvidia’s products (which by the way have developed into ‘AI factories’ with complex ecosystems over the years). But it is not only companies spending money on AI. In the most recent call, CEO Huang said that AI spending of sovereigns will reach a high-single-digit billion US-Dollar amount this year, and mentioned among others Germany, Italy, Japan and Switzerland. Looking at the value chain, Nvidia’s GPUs (graphic processing units) are primarily manufactured by Taiwan Semiconductor Manufacturing Company (TSMC). The more orders TSMC gets, the more likely it is that additional capacities and new plants are needed, which will then benefit semiconductor equipment manufacturers like ASML or ASM International.

Semiconductor sector

The crucial question is if Artificial Intelligence is just a bubble, or a bigger revolution than the internet. We are regular attendees of the ITF World Conference in Antwerp, which is one of the most important events for semiconductors & systems in Europe. The fair is organized by IMEC (Interuniversity Microelectronics Centre), a leading research and development organization, and brings together many of the most important companies in the semiconductor industry from around the world.

Some of the brightest people on the planet present their views on the future of the industry, and a few of the most interesting facts are worth mentioning.

Firstly, in the 1950s, the knowledge in medicine was estimated to double approximately every 50 years. This rate has significantly increased over time, with current estimates suggesting that medical knowledge now doubles every few months. Main drivers are digitalization, big data, global collaboration and artificial intelligence.

Secondly, digital twins are crucial for the future. Thanks to powerful computers, which enable real-life simulations, everything, from small products, to cars, to factories, to football stadiums, can be designed and tested in the metaverse. In the future, before a product, a machine or a whole factory or any other building is being build, its digital twin will be optimized, which leads to significant time (and money) savings. In the past, a prototype of a machine had to be built, then tested in a trial and error process, and once it was working well, it had to be integrated in the environment of a factory, for example into a production line. Nowadays, all these tests can take place ‘online’, assisted by artificial intelligence. Ideally, once the digital twin has been optimized, the machine can be built and will work straight away. To realize this, simulations are getting bigger and more realistic, therefore generate more data, which then need more powerful computers to analyse, optimize and store the data. This is usually done in the cloud so that colleagues around the world can work on those simulations together in real time.

Thirdly, in the automotive industry, future cars will be SDVs (software defined vehicles). In the past, the development of cars took at least three years, then they were sold, and 20 years later many of these old, outdated products were still being used. Future cars will be built with significant headroom, which means that they will be equipped with more sensors, cameras and computing power than they need. Over the lifetime of a car, updates can be made online, additional features like for example additional power, can be enabled. In theory, these cars can keep up with all future developments. This means as well that going forward, car manufacturers will have a very close and very long relationship with its customers, while currently they lose many customers at the end of the warranty period.

Last but not least, factories will change significantly going forward. In the past, when a robot broke down, it stood still until an engineer arrived and fixed it. In the future, predictive maintenance will prevent the robot from breaking down, and the engineer will be replaced by another robot. Machines will communicate with each other and fix each other. One of the key challenges of many countries is the lack of skilled labour. Robots have the advantage that they don’t get tired, can work 24 hours, 7 days a week, don’t get sick, and on top of that, don’t ask for a salary increase. Needless to say that this process needs vast amounts of computing resources as well.

A big topic in this context obviously is energy consumption. Currently, global datacenters consume more power than all of Germany and by 20230, global datacenters could consume more power than all of India! Going forward, higher performance has to go hand in hand with lower energy consumption. Nvidia’s new product Blackwell, for example, is significantly more powerful than its predecessor, while at the same time consuming 25% less energy.

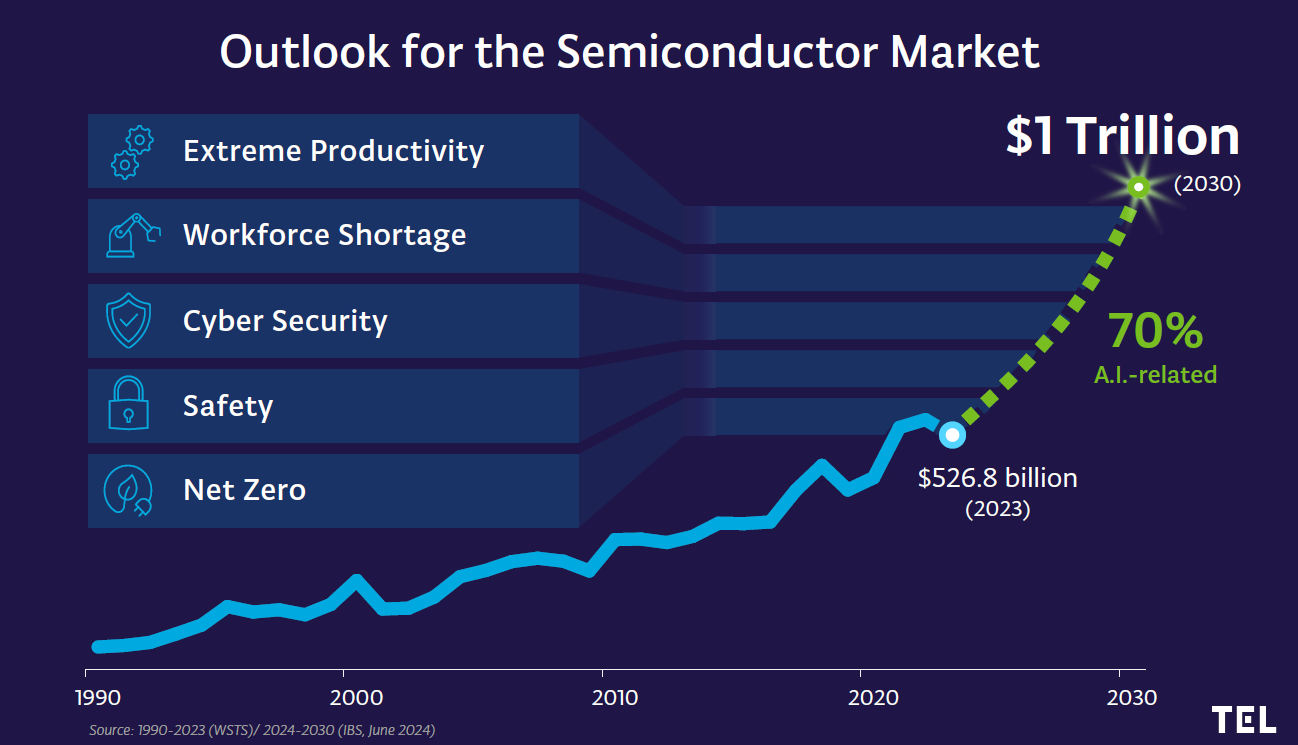

And last but not least, the chart below illustrates the expectations of the semiconductor industry for the coming years, and the main demand drivers:

The MW Actions Europe fund is a sub-fund of the Luxembourg SICAV MW ASSET MANAGEMENT. Please contact MW GESTION fund management or your financial advisor for further information.

At the time of writing, MW GESTION ACTIONS EUROPE held the following listed securities:

- Apple, representing 2.0% of assets under management

- ASM International (6.7% of total assets)

- ASML (7.4% of total assets)

- Ferrari (6.0% of assets under management)

- Novo Nordisk for 6.4% of outstandings

- Nvidia with 4.5% of assets under management

Written on 5 June 2024

Communication-Marketing

The MW Actions Europe fund is a compartment of the Luxembourg SICAV MW ASSET MANAGEMENT. You should contact the fund management company MW GESTION or your financial advisor for more information.

Past performance is not a reliable indication of future performance. Past performance is no guarantee of future performance.

The content does not constitute a recommendation, an offer to buy, a proposal to sell or an invitation to invest.

Further information is available on the company's website: www.mwgestion.com, in French, English and Italian.