Article 8

Since the end of May 2024, MW Actions Europe is an Article 8 fund under the European Union’s Sustainable Finance Disclosure Regulation (SFDR). Information about our ESG policies can be provided upon request.

What happened in the markets last month

In June, many US indices hit record highs again while most European markets underperformed following the strong showing by far-right parties in the European Parliament elections. The French lower-house dissolution by President Macron sent the CAC40 plunging. Both the European Central Bank and the Swiss National Bank have cut interest rates, while the Federal Reserve held them stable. Overall expectations for a rate cut in the United States have fallen from 160 bps at the beginning of the year to just 45 bps at the end of H1. US inflation data released in June showed declines for both headline and Core inflation in May while the US Macro data seriously disappointed in the first half of the year and crashed to the worst level since 2016. Interestingly the alternative measure of inflation, Truflation, keeps falling and printed at ‘only’ 1.85% at the end of June. The Japanese Yen weakened beyond 160 per US-Dollar, the weakest level since 1986. Volatility in the US fell to the lowest daily reading since 2019, but historically the volatility index VIX rises 25% from July to November during election years. In the past, the S&P 500 experienced a 3%-5% pullback a month before the Presidential election, but rallied nearly 10% between election day till the end of the year. After the US Presidential debate, odds of Donald Trump winning the election surged to 60% while odds of Biden winning have collapsed. In Germany, 11000 companies filed for insolvency in the first half of the year, which is the highest level since 2016.

What happened in the fund last month

First of all, regarding the uncertainty around the French elections, it is important to note that the fund’s exposure to French stocks is around 19%. The biggest holdings in France are Air Liquide, Dassault Systemes, Hermes, L'Oreal, LVMH and Schneider, and these companies do business around the world. For Hermes, LVMH or Schneider, for example, France represents less than 10% of total sales, hence we do not expect any significant impact from French politics on the fund.

During the month of June, we attended 5 Conferences in person and met with executives of many companies. The overall message was that most trends from Q1 have continued in Q2 as well. What became crystal clear is that nowadays every CEO has to have a strategy for Artificial Intelligence in place. Nearly every company is in the process of finding use cases which help to cut costs and/or to increase sales, and in many cases this requires upgrades to the existing IT infrastructure.

What happened in the fund in the first half of the year

Biggest gainer year-to-date was Nvidia with a gain of more than 150%. This is on the back of results which showed for the first quarter of the year an increase in revenues of 262% and in earnings of 462% versus Q1 last year. The outlook for the next quarter implies sales growth of another 8% versus the last quarter. According to Bloomberg estimates, revenues in 2025 are expected to grow by more than 10 times compared to 2020, and then double again by 2028. Earnings per share were at 1$ in 2020 and are expected to reach $26 in 2025 and $40 in 2028.

ASM International (+52% ytd) and ASML (+42% ytd) were driven by hopes that more demand for Artificial Intelligence will prompt semiconductor manufacturers like for example TSMC to increase their capacities and build more plants, and in that process buy more machines from these semiconductor equipment companies. Other gainers include Novo Nordisk (+45%) on unabated strong demand for obesity (and diabetes) drugs or Ferrari (+25.5%), which is more or less sold out for the next 2 years.

On the negative side, Soitec lost 35.6% as inventories in the smartphone market are reducing demand for its products. Carl Zeiss Meditec (-32.2%) had to publish another profit warning due to low demand for its products in the USA and in China, and was subsequently sold. Even the best companies experience weak quarters from time to time, but after several profit warnings in a row, at some point our trust in management (and to a certain degree in the business model) was just broken.

Since the start of the year, we have made limited changes to the portfolio. We have sold our (small) positions in Carl Zeiss Meditec, Hershey, Interpump, Shurgard and Sixt, as we have concerns about their structural growth prospects. With the exception of Hershey, earnings of those companies are expected to fall this year, and even for Hershey expectations are only for a minimal growth of earnings. We have initiated new positions in BE Semiconductor, GTT and SAP, where we see better prospects for future growth both in the short- and the long-term.

Fund characteristics

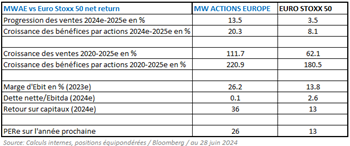

It is our aim to buy great companies, and hold them for as long as possible to benefit from the compounding of their earnings. We look for certain characteristics in this process, and like to summarize some of them in the table below:

Growth of our holdings was, and is expected to be, superior to the broader market. Margins and returns are higher, and on average, they have hardly any debt. Unfortunately, this significantly higher quality comes at a higher price as well. But currently our holdings trade at a discount of 9% to their average valuation over the last 10 years, while the Euro Stoxx 50 trades at a discount of just 5% compared to its own 10-year history. Another interesting factor regarding valuation is that analysts whose estimates are compiled on Bloomberg see an average upside of 16% for our holdings for the next 12 months.

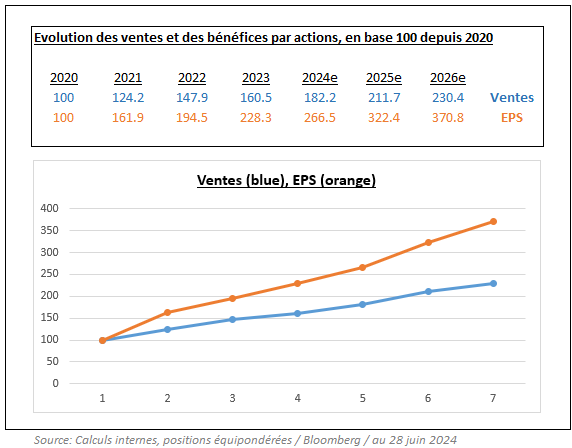

It is our belief that share prices follow earnings over the long term, and the chart below shows the past and future development of our current holdings’ sales and earnings.

The MW Actions Europe fund is a sub-fund of the Luxembourg SICAV MW ASSET MANAGEMENT. Please contact MW GESTION fund management or your financial advisor for further information.

At the time of writing, MW GESTION ACTIONS EUROPE held the following listed securities:

- ASM International (7.4% of total assets)

- Air Liquide (3.3% of total assets)

- ASML (7.6% of total assets)

- BE Semiconductor (2.5 % of total assets)

- Dassault Systemes (0.6% of total assets)

- Ferrari (6.2% of total assets)

- GTT (1,6% of total assets)

- Hermes (2.1% of total assets)

- L'Oréal (2.1 % of total assets)

- LVMH (3.9 % of total assets)

- Novo Nordisk (6.0% of total assets)

- Nvidia (3.8% of total assets)

- SAP (2.0% of total assets)

- Schneider (3.1% of total assets)

- Soitec (0.6 % of total assets)

Written on 10 July 2024

Communication-Marketing

The MW Actions Europe fund is a compartment of the Luxembourg SICAV MW ASSET MANAGEMENT. You should contact the fund management company MW GESTION or your financial advisor for more information.

Past performance is not a reliable indication of future performance. Past performance is no guarantee of future performance.

The content does not constitute a recommendation, an offer to buy, a proposal to sell or an invitation to invest.

Further information is available on the company's website: www.mwgestion.com, in French, English and Italian.