What happened in the markets last month

August started with a sea of red due to recession fears in the US after weak jobs data and the Bank of Japan’s decision to raise interest rates for the first time in 30 years. As a result, the Yen strengthened against the US-Dollar, which led to an unwinding of carry trades, and the Nikkei had its biggest 2-day drop in history (only to rebound strongly after the Bank of Japan said they won’t raise rates when the market is unstable). In addition to that, chipmakers saw their biggest two-day drop since 2020 after Intel published disappointing results. Its shares fell nearly 30%, the biggest one-day drop on record. The volatility index VIX hit a value of 65, the 3rd biggest spike in history. One day later, the index fell 41%, the largest move lower on record. The percentage of Bulls in the Investors Intelligence Sentiment Index moved down over 17% in 2 weeks at the beginning of the month, the biggest 2-week % drop in Bulls since the October 1987 crash.

After this panic, though, markets recovered thanks to reassuring economic data in the US. Gold, bonds and stocks rallied after Fed Chair Jerome Powell said, ‘The time has come for policy to adjust’. The US-Dollar tumbled towards the lowest level of the year, and now 93% of 189 global asset managers surveyed by Bank of America expect global interest rates to be lower within the next 12 months. The US crude oil production hit a record high, copper inventories jumped to the highest level in more than 4 years, and the Bloomberg Commodity Index hit its lowest level since 2021. Truflation, a company providing real-time, independent data, sees the US inflation well below 1.5% currently. Foreign investors pulled a record amount of money from China last quarter. Chinese home prices declined by the largest amount in history in July, and Consumer Confidence fell to a record low.

In the Eurozone, headline annual inflation decelerated to 2.2% in August after 2.6% in July, the lowest level in three years. German economic data deteriorated further, while the French economy got an Olympic boost.

What happened in the fund

Ferrari shares hit record highs during the month after another set of good quarterly results. In Q2 2024, a 3% growth of shipments lead to a 16% revenue growth and a 25% growth of earnings per share thanks to ‘mix and personalizations’, which represent 20% of car & parts revenue now. The biggest element of these personalizations are carbon finishes, both inside and outside the car. The order book is only flat, but the reason is that most models are sold out. And while we usually include numbers and graphs in this email, it may be worth to just look at the newest model:

Nvidia reported results at the end of August and, to quote CEO Huang, ‘achieved record revenues as global data centers are in full throttle to modernize the entire computing stack’. Overall results were better than expected. Q2 revenues were up 15% versus the previous quarter and 120% versus Q2 last year with an adjusted gross margin of 75.7%. For Q3, Nvidia expects revenues to increase by 8% versus Q2. Nvidia shares had sold off at the beginning of the month after reports about delays of their new product, the Blackwell architecture. This was confirmed, but demand for the older Hopper product shows no signs of weakness, hence the impact on results should not be material. Nvidia’s share price lost 7% on the day, as results were not as spectacular as in the previous quarters. Nevertheless, most analysts regarded the results as bullish and increased their price targets.

In recent months, though, there were increasing doubts of the Returns on Investments for Artificial Intelligence. But at this point in time, it is probably quite risky to not invest in AI. If you decide to not invest, you risk falling behind technologically, and risk losing market share. If for example Apple really manages to sell 10% more of the new iPhones thanks to new AI capabilities, which may be more ‘marketing’ than anything else, it may be well worth the investments.

And as most people think that everyone owns Nvidia already, it is worth mentioning that Nvidia is one of the two most under-owned stocks among actively managed portfolios versus the S&P500 according to Morgan Stanley. The average active ownership is 2% below the benchmark. Another interesting comment regarding Artificial Intelligence was made by the Walmart CEO, who recently said that the company used multiple Large Language Models to accurately create or improve over 850,000,000 pieces of data in the catalogue. Without the use of generative AI, this work would have required nearly 100x the current headcount to complete in the same amount of time.

Looking ahead:

Since 1964, the average performance of the S&P500 in September has been -0.7%, by far the worst month of the year. And it is the only month which has a probability of a positive performance below 50% (45%). This is even more applicable in US election years when both September and October had been very weak historically (before a strong rebound in November and December).

To put this into perspective, though: Since 1980, an investor buying the S&P500 Index 5% below its recent high would have generated a median return of 6% over the subsequent 3 months, enjoying a positive return in 84% of episodes. And stock market corrections are a common occurrence. Since 1928, the S&P 500 has experienced a decline of 5% or more in 94% of years. A correction of 10% or more happened in 61 out of the last 96 years, while a 20% drop or more took place in 25 years.

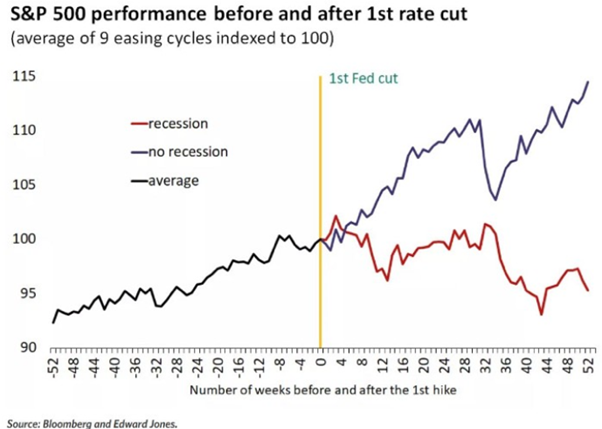

Last but not least, there is currently a big discussion about the performance of stock markets after a US rate cut. In the past, it clearly mattered if the economy entered a recession (stocks fell), or not (stocks rose):

But as we cannot predict the future, unfortunately, we buy what we regard as great companies with strong market positions, good track records and above-average margins coupled with very little debt, which have proven that they can weather difficult environments.

On the day of writing this article, MW GESTION ACTIONS EUROPE holds the following quoted securities:

• Ferrari for 6.7% of its outstandings;

• Nvidia for 3.1% of its outstandings;

Written on 10 September 2024

Communication-Marketing

The MW Actions Europe fund is a compartment of the Luxembourg SICAV MW ASSET MANAGEMENT. You should contact the fund management company MW GESTION or your financial advisor for more information.

Past performance is not a reliable indication of future performance. Past performance is no guarantee of future performance.

The content does not constitute a recommendation, an offer to buy, a proposal to sell or an invitation to invest.

Further information is available on the company's website: www.mwgestion.com, in French, English and Italian.