What happened in the markets last month

Donald Trump has won the US presidential election and the majority in both houses of Parliament. As he is seen as ‘market friendly’ and will put ‘America first’, it is no surprise that the S&P 500 index closed the month at record highs and the US Dollar strengthened against most other currencies. Bitcoin rallied nearly 40% boosted by the prospect of a Congress featuring pro-crypto lawmakers, and probably thanks to Elon Musk’s prominent role during the election, Tesla shares soared nearly 40%. And despite the fact that the Federal Reserve cut interest rates, the threat of additional import tariffs led to a sharp rally of US Treasury yields, which touched 4.50%, and an underperformance of stocks in Europe and in Emerging Markets. Economic data during the month remained solid, but inflation seems to re-accelerate. The Consumer Price Index, for example, accelerated to 2.6% in October from 2.4% in September. It is worth noting that US corporate bond spreads have declined to the lowest in 26 years, and junk bond spreads are the lowest since 2007.

After the election, the Euro dropped the most since 2016. Economic data in Europe mostly disappointed, while inflation seems to be on the rise again. Purchasing Manager Indices dropped sharply (while the US PMI is at the highest level since April 2022), and Manufacturing PMIs have been in contraction for longer than they have ever been before for Germany, and almost the longest for France. Not surprisingly therefore, the European Central Bank warned that low growth and high debt risk another Eurozone crisis. To make things worse, the political situation in key countries deteriorated. In Germany, Chancellor Scholz called for a snap election after his three-way coalition finally collapsed, and speculations about a fall of the Barnier government in France led to a sharp increase of the French 10-year bond yield, which is now close to Greek’s 10-year yield.

The geopolitical situation remains fragile as Russia warned of a possible nuclear response if Kiev used Western-made missiles, and China stated that it wanted to be friends with the USA, but would be ready for a fight if necessary. Gas prices rallied sharply and Coffee prices reached the highest levels since 1977, while Gold fell back from recent record highs.

What happened in the fund in the last quarter

ASML held its Capital Markets Day, during which the group reiterated its 2030 objectives (initially given in 2022) of sales between €44 billion and 60 billion (versus circa 27 billion this year) and a gross margin between 56% and 60%. This is based on the unchanged assumption of global semiconductor sales of over $ 1 trillion in 2030, which would mean an annual market growth rate of ca. 9% between 2025 and 2030. This confirmation, coming less than a month after the profit warning for 2025, was seen as disappointing by some and as a relief by others. The previous outlook did not include the Artificial Intelligence boom, which is expected to fuel strong growth especially in the area of servers, datacenters and storage. But at the same time, growth in areas like smartphones, PCs, automotive and industrial electronics is weaker than previously expected, hence the overall outlook remained unchanged. The graph below shows the expected increase of global semi sales by 2030, and illustrates the increasing significance of high performance computing.

.png)

Source: ASML

Nvidia is seen as the biggest beneficiary of high performance computing, and the company’s results confirmed this view. Revenue and earnings per share in Q3 nearly doubled versus Q3 last year, and according to broker estimates, revenues are expected to double again from $ 129 billion this year to $ 263 billion in FY2028. Probably the most important comment from CEO Huang was that he does not expect a slowdown in investments, as according to him $ 1 trillion datacenters globally need to be modernized. More computing power is needed, while power consumption needs to be reduced. And crucially, demand for the new Blackwell product is expected to exceed supply through the next quarters. The company announced that India adopted Nvidia accelerated computing and is building AI factories with tens of thousands of Nvidia GPUs. And while the company’s automotive business has become relatively small due to the strong growth of datacenters, it is interesting to hear that Volvo Cars is rolling out its fully electric EX90, built on the Nvidia Drive system, which is capable of more than 250 trillion operations per second.

Looking ahead

I have just read an interesting comment regarding market forecasts: ‘The S&P 500 has generated 15% annual returns (including dividends) over the last 15 years. And all the ‘New Normal’ people from 2009 who warned of increased volatility and ‘a lower return environment’ are still on TV peddling their latest worthless forecasts. They do wear exquisite suits.’

It is this time of year again when strategists everywhere give their educated views about what 2025 will bring. While it is important to know possible scenarios for the time ahead, it is fair to say that many unforeseen things are going to happen. So let’s look back one year, to the beginning of December 2023 to see what strategists expected back then. The average year-end 2024 target price for the S&P 500 was 4902 (versus a level of 6037 at the time of writing), and JP Morgan even predicted a drop to 4200. Since then, strategists upgraded their 2024 year-end target price to 5734 as per today. For the Euro Stoxx 50, analysts expected an increase of just 1% in 2024 to 4545 (versus a level of 4878 at the time of writing). For 2025, strategists see on average around 5% upside for both the S&P 500 (average price target is 6320) and the Euro Stoxx 50 (5120). But please keep in mind that basically nobody predicted that the S&P 500 would rise by more than 20% both in 2023 and in 2024.

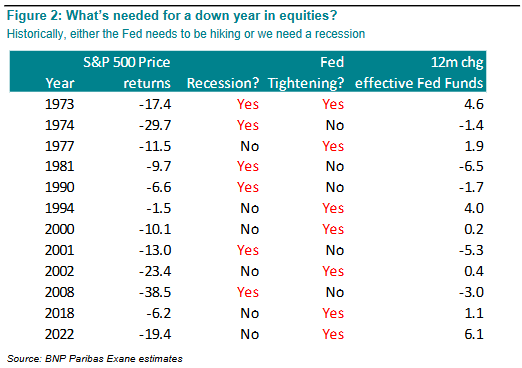

US stocks are getting ever more dominant and have reached the highest level ever in the MSCI World Index with well above 70%, therefore it is worth reminding ourselves what is needed for a down year in the S&P 500 Index. The answer is simple, as since 1973, the index only fell when either the Fed hiked interest rates or the US was in a recession. What becomes clear when looking at the table as well is that down years have been relatively rare (12 since 1973).

Looking at recent political developments, the risk of a recession does not seem imminent and further fiscal easing is also likely. On the back of the re-acceleration of inflation, the FED turning more hawkish is probably one of the biggest predictable risks for the stock market. Trump’s election will lead to more uncertainty and more volatility, as policy changes nowadays seem to be announced via social media by himself and his aides. Over the long term, earnings drive stock market returns, and ongoing solid earnings growth is expected in the US. In Europe on the other hand, aggregated earnings in the Euro Stoxx 50 Index are expected to fall in 2024 (partly explaining the region’s underperformance), but are expected to recover in 2025.

Here, the situation looks even more complicated with political uncertainties in France and Germany, coupled with a weak economy, and potentially the threat of additional tariffs in the US. China is a big unknown as well as the effects of the recently announced stimulus measures is as unclear as the future relationship with Donald Trump. Stock market valuations reflect these factors already, as US markets look very expensive compared to Europe, but this has been the case for many, many years now. So maybe it will be Europe’s year to shine after all? We are not taking any bets on valuation gaps between countries, but invest in the best companies we can find, with the aim of holding them for many years.

Written on 12 december 2024

On the day of writing this article, MW GESTION ACTIONS EUROPE holds the following quoted securities:

- ASM International for 6.5% of its outstandings

Communication-Marketing

The MW Actions Europe fund is a compartment of the Luxembourg SICAV MW ASSET MANAGEMENT. You should contact the fund management company MW GESTION or your financial advisor for more information.

Past performance is not a reliable indication of future performance. Past performance is no guarantee of future performance.

The content does not constitute a recommendation, an offer to buy, a proposal to sell or an invitation to invest.

Further information is available on the company's website: www.mwgestion.com, in French, English and Italian.