What happened in the markets last month

While big US indices hit record highs in early December, they fell back in the second half of the month after the US central bank FED cut interest rates as expected, but dialed back expectations for further rate cuts in the future. As a result of this, US Treasury markets and stocks tumbled, while the US Dollar rallied to the strongest level in more than two years. The volatility index VIX spiked 74%, and for the first time since August, CNN’s Fear & Greed Index showed ‘extreme fear’. Both consumer and producer prices accelerated, and as macro surprises overall disappointed, stagflation fears started to rise again. At least a government shutdown could be averted.

In Europe, both the European and the Swiss Central Bank cut rates by 25 bps and 50 bps respectively. Economic data remains disappointing, the German Ifo Business Index for example fell to its lowest level since May 2020, and the ZEW Index of current economic conditions fell to near the lowest level on record. France saw the biggest drop in employment since the pandemic. Political uncertainty has increased, as in France, Mr. Macron appointed a new prime minister, and in Germany, Olaf Scholz lost a vote of confidence, which triggered new elections in February 2025.

China signaled bolder stimulus for next year, but economic data remained uninspiring overall, and the one-year bond yield sank to 1% for the first time since 2009. The Japanese 10-year yield rose to the highest since 2011. Bitcoin hit a new all-time high and global debt rose to a new record of $ 323 trillion. Cocoa and coffee futures hit new highs while diamond prices fell to their lowest level this century.

What happened in the fund in the last month

In December, Novo Nordisk shared the results of their REDEFINE 1 trial, a phase 3 study focused on the potential new blockbuster drug CagriSema. This medication is a combination of cagrilintide and semaglutide. The trial included 3,417 adults who were either obese or overweight and had additional health conditions. The study revealed that CagriSema led to a significant weight loss of 22.7% after 68 weeks. This result was better than what was achieved with a placebo or with the individual components, cagrilintide and semaglutide, on their own. However, it fell short of Novo Nordisk's earlier target of 25% weight loss. In terms of safety, CagriSema showed a favorable profile. The side effects were mostly mild to moderate gastrointestinal issues, which are common with GLP-1 receptor agonists.

When compared to other treatments, CagriSema's weight loss results were significant. However, they did not surpass those of Eli Lilly's tirzepatide, which achieved around 23% weight loss in similar trials, and due to this fact, the share price fell more than 20%. It is worth noting that we had reduced our shareholdings in the run-up to this event as we do not like betting on the outcome of clinical studies.

2024 review

Europe significantly underperformed compared to US markets, and this gap widened after the US election because of fears that Trump’s tariffs would hurt most trading partners. US interest rates rose sharply, driven by high debt levels and fears of Trump's inflationary policies. China's economy struggled, with yields hitting record lows. Economic sentiment in key European countries reached its lowest since Covid, and political uncertainty increased, particularly in France and Germany. The US outperformance was driven by just a few stocks, most importantly Nvidia, without which the S&P 500 Index would have actually underperformed European markets since 2022. In Europe, 'Value' stocks outperformed 'Growth' and 'Quality' stocks, and best-performing sectors were Banks, Insurance, and Telecommunications, while Healthcare, Luxury, and Technology lagged. Some of the biggest European growth companies underperformed the broad market significantly, among them ASML, Kering, LVMH and Novo Nordisk.

2025 outlook

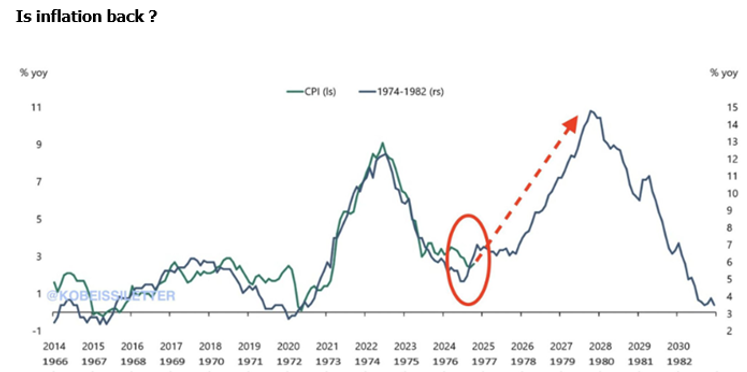

It is important to emphasize that our investment philosophy does not put too much weight on predicting future macro developments, as we regard such predictions as simply impossible. Most strategists expect an upside of about 5%-10% for both the US and European equity markets. Earnings per share are projected to rise by 3% for the Euro Stoxx 50 and 13% for the S&P 500. Rate cuts by most Central Banks around the world were supportive for stock markets in 2024, so a re-acceleration of inflation, and with that a pause in interest rate cuts, or even hikes, pose a significant risk for markets. One year ago, the chart below was cited by many bearish strategists when talking about key risks for 2024, but inflation only started to pick up again in the last months of the year, making the comparison of current inflation with the 1970s potentially relevant again.

Source: Apollo

Other concerns include spiraling US debt and additional inflation from Trump's policies. Geopolitical uncertainties may rise with the new US president, affecting peace prospects in Ukraine. Trump's focus on stock markets and social media activity could increase volatility. US market valuations seem high, but less so without the top 10 stocks. AI was a key driver for top US performers, and reduced investments pose a risk. China's stimulus measures could impact global inflation if successful, and Japan might raise interest rates. Europe faces political uncertainty and structural issues.

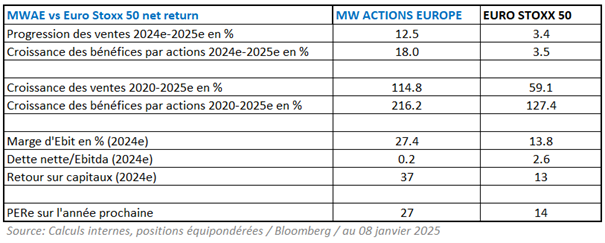

But notwithstanding these potential risks, the fund's strategy remains unchanged, focusing on investing in great companies for the long term. The table below shows the characteristics of our holdings compared to the Eurostoxx 50 Index. Our companies show higher growth, better margins and returns, and have nearly no debt.

Obviously, this superior quality comes at a price. But if we compare the valuation of our holdings versus their average valuation of the last 10 years, they currently trade at a 5% discount. While the Euro Stoxx 50 Index multiples look cheap, valuation is in line with its average valuation over the last 10 years. In addition to that, according to Bloomberg, analysts see on average 16% upside for our holdings for the next 12 months.

In our view, this table serves as confirmation that we have not made, and are not planning to be making, any changes to our investment philosophy. The future is always uncertain, and our holdings have proven that they can navigate in choppy waters as well, meaning that they will be able to continuously increase sales and earnings in the future.

Written on 15 january 2025

On the day of writing this article, MW GESTION ACTIONS EUROPE holds the following quoted securities:

- ASM International for 6.5% of its outstandings

- LVMH for 3,3% of its outstandings

- Novo Nordisk for 1.9 % of its outstandings

- Nvidia for 2,9% of its outstandings

Communication-Marketing

The MW Actions Europe fund is a compartment of the Luxembourg SICAV MW ASSET MANAGEMENT. You should contact the fund management company MW GESTION or your financial advisor for more information.

Past performance is not a reliable indication of future performance. Past performance is no guarantee of future performance.

The content does not constitute a recommendation, an offer to buy, a proposal to sell or an invitation to invest.

Further information is available on the company's website: www.mwgestion.com, in French, English and Italian.