Due to the sharp selloff in global equity markets, I want to first comment on this very briefly despite the fact that the comment is for March.

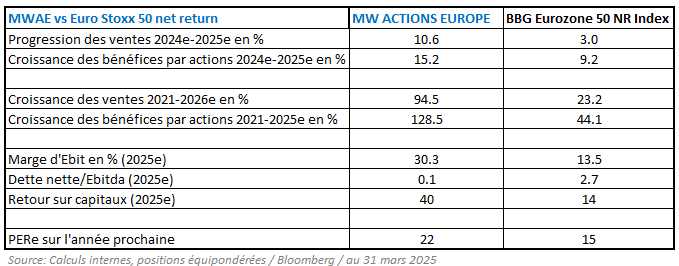

Donald Trump’s announced tariffs were far higher than expected and feared. And while he said that this is the worst case (unless countries try to retaliate), global markets crashed and the Volatility Index VIX hit a value above 60, only the second time since the pandemic. It has to be seen if countries which want to cut their own tariffs for U.S. goods and negotiate lower tariffs with the U.S.A. can reduce the imposed ‘worst-case-tariffs’. An interesting comment was made by Eric Demuth, CEO of Bitpanda, one of Europe’s most successful fintechs. He believes that Mr. Trump is desperately crashing the economy as the U.S.A. has a huge amount of debt to refinance in 2025, and the lower the interest rates, the cheaper the refinancing. And once this is done, he expects massive support for the economy, just like after the Covid-pandemic. Mr. Trump’s motives are not clear currently, and the situation remains fluid. And while in the table below, the average price-to-earnings ratio of companies we own, as per end of March, stood at 22, it has by the time of writing fallen to below 20, a 30% discount versus the average P/E ratio of the last 10 years (28x).

What happened in the markets last month

At the beginning of the month, U.S. President Donald Trump imposed 25% tariffs on most Canadian and Mexican imports and raised the charge on China to 20%, affecting roughly $1.5 trillion in annual imports. In response, Canada announced a sweeping package of levies, and China retaliated by imposing tariffs as high as 15% on U.S. exports. While Mr. Trump said that the U.S. economy would face a transition but no recession, U.S. 5-year government bonds priced in a more than 50% chance of a recession in the next 12 months. In the middle of the month, Trump announced that he would impose 200% tariffs on all wines and other alcoholic products from EU countries unless the Union removed its tariffs on whisky. Economic data remained rather mixed; for example, U.S. Consumer Confidence Expectations fell to the lowest in 12 years. The FED held rates steady as expected but cut its Gross Domestic Product growth outlook for 2025 from 2.1% to 1.7%, while simultaneously raising inflation forecasts, fueling stagflation fears further. Global stocks sold off and bonds climbed at the end of the month after Mr. Trump signed a proclamation to implement a 25% tariff on auto imports and announced the start of his reciprocal tariff push with all countries on April 2. Regarding the war in Ukraine, the U.S. President ordered a pause on all military aid to Ukraine after a public clash with the Ukrainian president, and on the last day of the month, he expressed anger at Mr. Putin for casting doubt on President Zelenskiy’s legitimacy as a negotiation partner. In addition to that, Mr. Trump raised the threat of bombing Iran unless it signed a deal renouncing nuclear weapons.

In Europe, Germany launched a EUR 500 billion infrastructure fund and announced that it would spend ‘whatever it takes’ on defense. As a result, German bonds suffered their worst day since the months following the fall of the Berlin Wall. As expected, both the European Central Bank and the Swiss National Bank cut interest rates. The ECB cut its growth outlook for this year and next year and revised its inflation expectations upward. The Bank of France cut its 2025 growth forecast to 0.7% from 0.9%, marking the weakest annual expansion since the COVID-19 pandemic. Eurozone Purchasing Manager Indices increased in the manufacturing sector but deteriorated in the much larger services sector.

China set a bullish growth goal of about 5%, despite U.S. tariffs, but its consumer inflation fell far more than expected, droppingl below zero for the first time in 13 months, signalling persisting deflationary pressure. Japan’s government bond yields reached their highest levels in more than a decade. Gold hit a new record high, surging more than 16% in Q1, its best start to a year since 1986, while oil contacts touched their lowest level in years.

What happened in the fund in the last month

Overall news flow from companies we own was rather light. The Swiss vacuum valve supplier VAT Group reported an 8% increase in sales in 2024 and provided an outlook for Q1 that was above analysts’ estimates. Analysts currently expect a sales increase of 20% in 2025, but visibility for the company remains low. While the first half of the year is expected to be flat versus 2024, the hope is for a pick-up in activity in the second half.

The Italian IT company Reply managed to increase sales in 2024 by more than 8%, with profits rising significantly more, thanks to its ability to interpret market needs and develop cutting-edge digital solutions in an increasingly dynamic and complex global context.

Our overall portfolio, though, was more affected by the tariff uncertainties, as outlined above. While a global tariff war will hurt growth, Mr. Trump’s continual shifts in his approach to tariffs led to sharp declines of many companies that generally benefit from global trade. Looking at some of the best-performing sectors in Europe in the first quarter, it is clear that sectors less affected by global trade have performed better—for example, banks, energy, insurance, telecommunications, and utilities. Among the worst-performing sectors were healthcare and technology, both of which benefited from superior structural growth in the past.

The new US tariffs will be announced on 2 April, and its impact will have to be seen. The new U.S. tariffs will be announced on April 2, and their impact remains to be seen. The ability of companies to pass on higher costs to consumers will be a key factor. A good example is Ferrari, which, just one day after the newly announced auto tariffs, stated that it would increase prices by up to 10% for some models while still confirming its full-year 2025 outlook, albeit with a potentially slightly lower margin.

It is worth noting that tariffs are probably not yet included in most analysts’ forecasts for the coming years, as nobody knows how severe they will be. As per the end of March, earnings for the companies we own were still expected to increase by 15% this year.

Global equity markets don’t like bad news, obviously, but even worse than that is uncertainty. As a result of that, it is interesting to see that the average valuation of the companies we own has fallen to levels which are now around 20% below their average valuation over the last 10 years, meaning that probably a significant reduction of the above mentioned 15% growth may already priced in. At the same time, the valuation for large caps in the Eurozone may look cheap, but is actually more than 10% above the average of the last 10 years. As per current estimates, the companies we own grew constantly in the past, and are expected to grow healthily going forward, while having at the same time superior margins and returns, and are basically debt-free:

Outlook

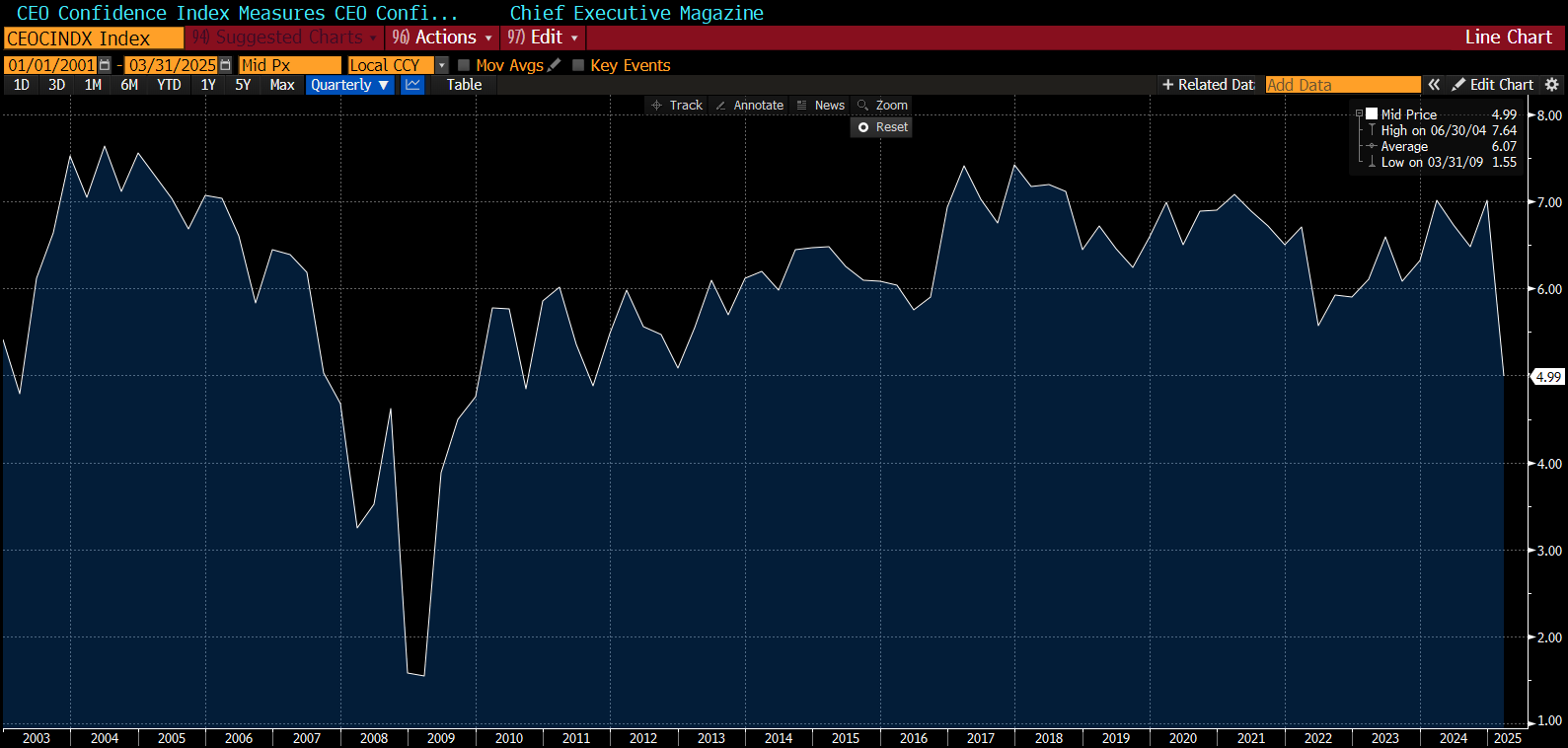

In my comment last month, I showed that global economic uncertainty is higher than ever before, and this is confirmed by the so-called U.S. Chief Executive Officer Confidence Index, which measures CEOs’ confidence in the economy one year from now. A low value indicates for example concerns about economic downturns or geopolitical risks, and this sentiment often reflects corporate investment decisions, hiring trends and economic momentum.

Source: Bloomberg

As can be seen, CEOs are the most pessimistic since 2011 and even more pessimistic than during the COVID-19 pandemic, which brought the world to a near standstill. While this survey is conducted in the U.S., it is likely that many CEOs in other countries share this uncertainty.

CNN’s Fear and Greed Index once again signals ‘extreme fear,’ reflecting extremely negative sentiment. We own companies that have done very well over long periods of times, and weathered many crises along the way. At this point, nobody can predict the outcome of what may become a global trade war, but companies with healthy balance sheets and a great track record of financial performance should be well-positioned to weather this storm as well.

Written on 9 April 2025

On the day of writing this article, MW GESTION ACTIONS EUROPE holds the following quoted securities: :

- Ferrari for 5.3% of its outstandings

- Reply for 2.3% of its outstandings

- VAT Group for 1.3% of its outstandings

Communication-Marketing

The MW Actions Europe fund is a compartment of the Luxembourg SICAV MW ASSET MANAGEMENT. You should contact the fund management company MW GESTION or your financial advisor for more information.

Past performance is not a reliable indication of future performance. Past performance is no guarantee of future performance.

The content does not constitute a recommendation, an offer to buy, a proposal to sell or an invitation to invest.

Further information is available on the company's website: www.mwgestion.com, in French, English and Italian.