What happened in the markets last month

Trade tensions and negotiations between the US, China, and the EU dominated the headlines. Global equities surged when China and the US agreed to lower tariffs for 90 days following talks in Geneva. President Trump floated various tariff threats, particularly targeting Europe and Apple. At the end of the month, he accused China of violating the agreement. The deadline for imposing 50% tariffs on the European Union was later extended, giving rise to the term "TACO-trade" (“Trump Always Chickens Out”). Although his tariffs were initially blocked by the trade court, a federal appeals court granted the President a temporary reprieve just one day later.

Domestically, the Trump administration introduced a major tax cut proposal, sparking resistance within the Republican Party and raising concerns over the growing national debt. This led to new multi-year highs in long-term yields in the US (and Japan). Meanwhile, the Federal Reserve kept interest rates unchanged and expressed caution about the inflationary impact of tariffs. The US economy showed signs of resilience, with moderate GDP growth, a strong labor market, and easing inflation. Despite—or perhaps because of—widespread investor pessimism, equities rallied, driven by systematic buying, solid earnings, and improving inflation data.

In Germany, CDU leader Friedrich Merz faced a challenging vote to assume the chancellorship, succeeding only on his second attempt. Meanwhile, EU member states gave initial approval to the planned defense fund. Economic sentiment has improved somewhat, supported by expectations of public investment and a degree of trade frontloading ahead of potential US tariffs. However, growth remains fragile, with weak underlying indicators. Unemployment in Germany, for example, has reached its highest level in at least 10 years.

In China, the economy has shown mixed signals. Services activity lost momentum, and exports initially dropped sharply due to trade tensions. In response, Beijing eased monetary policy. Later data showed a rebound in shipments to non-US markets and stronger-than-expected industrial output, though domestic demand remained weak. To support the economy, authorities cut key lending rates.

What happened in the fund in the last month

Ferrari posted solid Q1 results, driven by high levels of personalization (accounting for 19% of sales), a favorable product and geographic mix, F80 deposits, and tight industrial cost control. Tariff mitigation policies were swiftly and effectively implemented, with no uptick in cancellations. Management expressed strong confidence in the 2025 outlook, confirming that the entire 2026 order book is already covered and that tariff concerns have not led to order losses. Ferrari’s agile commercial response to tariff risks underscores the brand’s exceptional pricing power and customer loyalty.

Novo Nordisk delivered strong Q1 2025 results, with sales rising 19% year-over-year and operating profit up 22%, fueled by continued demand for its GLP-1 products, especially Ozempic and Wegovy. However, the company revised its full-year guidance downward to 13–21% sales growth (previously 16–24%) and 16–24% operating profit growth (previously 19–27%), citing intensified competition—particularly from Eli Lilly’s Zepbound—and pricing pressures. In the U.S., obesity care sales rose by a solid 40%, but this was far outpaced by the 137% (!) growth in "International Operations."

One notable challenge has been the increasing availability of compounded versions of GLP-1 drugs in the U.S. These unbranded formulations are prepared by specialized pharmacies and are legally permitted during periods of drug shortages. Although initially allowed due to limited supply of Wegovy, the FDA no longer lists it as being in shortage, which could eventually curb compounding. Nonetheless, these lower-cost alternatives have already gained some market share, raising concerns for Novo Nordisk around safety, brand erosion, and lost revenue.

In a surprising development, CEO Lars Fruergaard Jørgensen announced his resignation after eight years at the helm. Under his leadership, Novo Nordisk rose to become Europe’s most valuable company, primarily due to its success in obesity treatments. However, a mix of recent stock underperformance, supply constraints, growing competition, and a lukewarm market response to the next-generation weight-loss drug CagriSema has raised questions about the company’s ability to sustain its compounder-like growth trajectory. The board, in collaboration with the Novo Nordisk Foundation, is now seeking a successor to steer the company through its next chapter.

VAT Group, the Swiss manufacturer of high-performance vacuum valves and related components—primarily for the semiconductor, display, and solar industries—reaffirmed its optimistic outlook for the global semiconductor market at its recent Capital Markets Day, as outlined below:

![]()

The semiconductor market is expected to double over the next 5–6 years, while Wafer Fab Equipment (WFE)—specialized machinery and tools used in semiconductor fabrication plants to manufacture integrated circuits on silicon wafers—is projected to grow by 50%. Additional upside could come from increasing demand driven by artificial intelligence applications.

Despite this positive outlook, VAT Group revised its 2027 sales forecast downward, reducing the midpoint from CHF 2 billion to CHF 1.6 billion. The main factors behind this revision include recent turmoil in currency markets and slightly lower assumptions for WFE growth. As a result, the downgrade did not come as a surprise.

Nonetheless, the company continues to project strong performance, guiding for annual sales growth in the low to mid-teens (12%–15%) for the period 2025–2029—well above the expected growth of the overall WFE market. This anticipated outperformance is primarily driven by strong momentum in new product development and ongoing market share gains. VAT Group remains the clear market leader, with R&D spending in the semiconductor segment alone matching the total sales of its closest competitors. In an increasingly complex field, this significant investment further solidifies its technological leadership, as reflected by an already impressive market share of 71%—a figure expected to rise to 85% by 2029.

Outlook

Newsflow—and with it, sentiment in global markets—has improved markedly in recent weeks. This is perhaps best illustrated by CNN’s Fear & Greed Index, which has returned to the “greed” zone after spending more than two consecutive months in “fear” and “extreme fear” territory. Another key market sentiment gauge, the VIX volatility index, has dropped back below 20, after spiking above 50 in April.

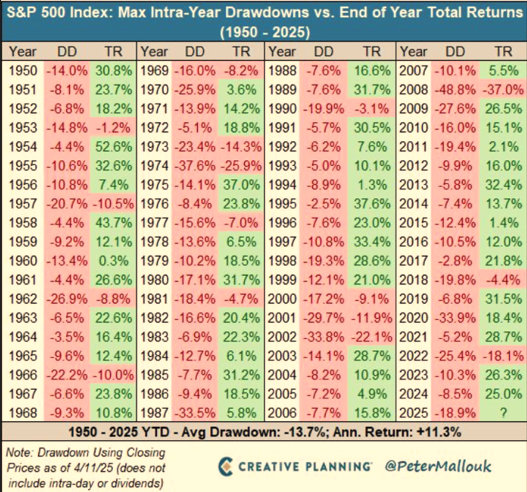

Last month, we highlighted the historically strong returns that tend to follow such periods of extreme fear. Market downturns are always difficult to navigate, and the saying “no pain, no gain” captures the reality of equity investing all too well. As the table below from Creative Planning illustrates, market drawdowns are a normal part of long-term equity investing.

While past performance is, of course, no guarantee of future results, it is worth noting that since 1950, the S&P 500 has delivered an average annual return of +11.3%, alongside an average annual drawdown of 13.7%.

Source: Creative Planning

Every period of market weakness comes with its own narrative and seemingly plausible reasons. However, history shows that such volatility is a normal part of market behavior. It is crucial not to panic, but instead to reassess the new facts and stay committed to the long-term strategy—in our case, investing in high-quality companies with the intention of holding them long-term to benefit from the compounding of their profits.

Written on 13 June 2025

On the day of writing this article, MW GESTION ACTIONS EUROPE holds the following quoted securities: :

Apple for 2.2% of its outsandings

Ferrari for 4.3% of its outstandings

Novo Nordisk for 2.9% of its outstandings

VAT Group for 1.4% of its outstandings

Communication-Marketing

The MW Actions Europe fund is a compartment of the Luxembourg SICAV MW ASSET MANAGEMENT. You should contact the fund management company MW GESTION or your financial advisor for more information.

Past performance is not a reliable indication of future performance. Past performance is no guarantee of future performance.

The content does not constitute a recommendation, an offer to buy, a proposal to sell or an invitation to invest.

Further information is available on the company's website: www.mwgestion.com, in French, English and Italian.